October 25, 2018

Canada, Toronto

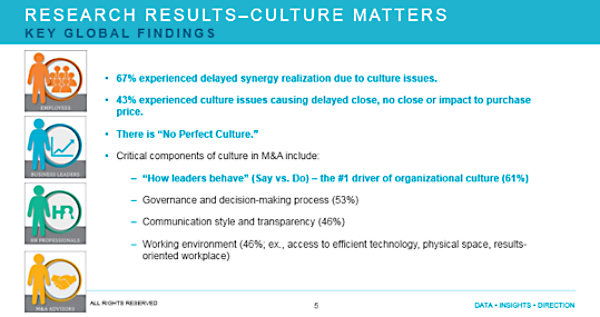

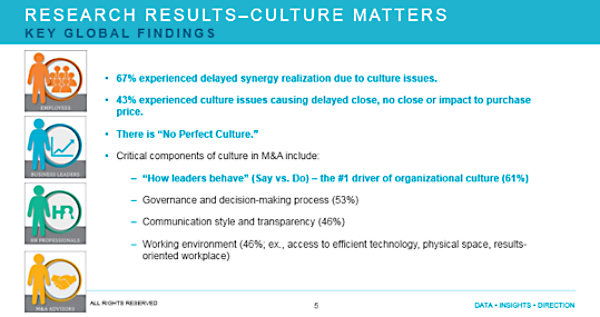

Mercer, a global consulting leader in advancing health, wealth and career, and a wholly owned subsidiary of Marsh & McLennan Companies (NYSE: MMC), revealed today that 43% of mergers and acquisitions transactions worldwide experienced such serious culture issues that deals were delayed, terminated or purchase prices were negatively impacted. In addition, 67% experienced delayed synergy realization due to culture issues (See figure 1). These alarming insights come from Mercer’s M&A Readiness Research™ series 3.0 report, “Mitigating Culture Risk to Drive Deal Value”. The research features survey and interview responses from more than 1,400 mergers and acquisitions professionals based in 54 countries, who collectively have worked on more than 4,000 deals in the past 36 months on both the buy and sell sides.

Figure 1: Culture is a significant disruptor of global M&A transactions

Source: Mercer, “Mitigating Culture Risk to Drive Deal Value”

“If the global deal making community intends to drive economic value for shareholders in mergers and acquisitions transactions, our research is crystal clear; culture matters,” said Jeff Cox, Mercer’s Global M&A Transaction Services Leader. “When looking to transform the workforce for the future of a newly formed organization, simply ignoring culture and employee experience is not an option.”

Additional findings from Mercer’s “Mitigating Culture Risk to Drive Deal Value” report include:

- 61% of respondents selected “How leaders behave, not just what they say” as the number one driver of organizational culture.

- This finding was even more pronounced in Canada as 71% of respondents specific to this country rated it as their number one driver.

- “Governance and decision-making process” (53%) and “Communication style and transparency” (46%) also ranked highly.

- Deal makers also said that 30% of deals fail to ever achieve financial targets, due to such culturally-related issues as productivity loss, flight of key talent, and customer disruption.

The report also extensively examines some of the varying attitudes and opinions of respondents based on role, industry, demographic and geography. For example, Human Resources professionals rate “collaboration” (69%) and “empowerment” (64%) as the most important components of culture, while executives rate “governance/decision-making process” (60%) as the most important.

Canadian findings highlight the importance of addressing culture and employee experience. In Canada, the overwhelming majority of respondents (89%) would consider leaving a job because the culture was not a good fit for them. Canadians have also experienced culture stresses in mergers - 62 per cent of respondents reported experiencing integration plan adjustments due to issues merging company cultures.

“Organizations place a tremendous amount of focus and resources on mergers and acquisitions yet so often fail in part because leaders neglect to address potential consequences of merging company cultures,” suggests Ilana Hechter, Partner, Career Business, Mercer Canada. “At the end of the day, companies can significantly enhance their success in these business-critical moments by educating and supporting leaders about the cultural implications.”

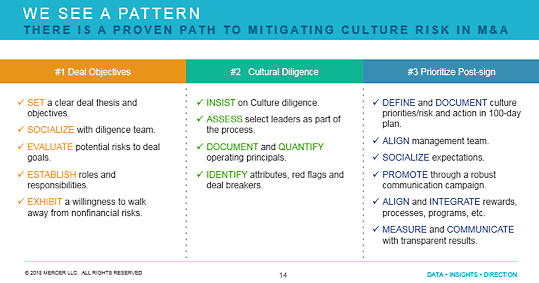

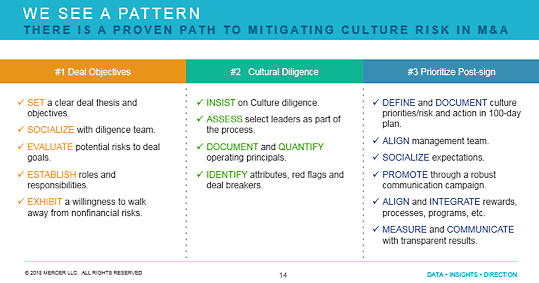

While alerting the global deal community to the culture risks endemic to mergers and acquisitions transactions, the report also offers definitive action steps as to how to best mitigate culture risk, including a three-step plan (see Figure 2):

- Clearly articulate deal objectives and risks

- Insist on confirmatory cultural diligence

- Prioritize culture, especially post-signing through first 100 days

Figure 2: There is a clear path to mitigating culture risk in M&A

Source: Mercer, “Mitigating Culture Risk to Drive Deal Value”

“Deal makers can mitigate mergers and acquisitions risk and drive deal value by putting culture at the center of business transformation,” said Mr. Cox. “Culture is a firm’s operating environment. It defines an organization, allows effective change of business strategy, and can provide a platform to attract and engage the right talent.”

To learn more, please visit our website. At this site, members of the media can also register for a webcast scheduled for Thursday, November 15 at 1:00 p.m. EST. At this time an executive summary is available and the full report will be available after the webinar. The summary, webcast and full report are all complementary.

ABOUT MERCER

Mercer delivers advice and technology-driven solutions that help organizations meet the health, wealth and career needs of a changing workforce. Mercer’s more than 23,000 employees are based in 44 countries and the firm operates in over 130 countries. Mercer is a wholly owned subsidiary of Marsh & McLennan Companies (NYSE: MMC), the leading global professional services firm in the areas of risk, strategy and people. With more than 65,000 colleagues and annual revenue over $14 billion, through its market-leading companies including Marsh, Guy Carpenter and Oliver Wyman, Marsh & McLennan helps clients navigate an increasingly dynamic and complex environment. For more information, visit www.mercer.ca. Follow Mercer on Twitter @MercerCanada.